By Amit Kapoor, Pradeep Puri and Ananya Khurana

As the world is shifting its attention to sustainable agriculture, millets are gaining limelight as a promising alternative to paddy production in India. The 6.2% CAGR of millets globally, and the remarkable 16% CAGR of millet in India from 2024 to 2030, validate it. With the growing popularity of millets, the time is ripe for policymakers to boost millet production. However, for an effective transition, it is imperative to get farmers on board and excited about the change.

Presently, paddy is the most cultivated crop in India, primarily due to skewed agricultural input subsidies. For instance, fertilizer usage in major paddy-producing states of Punjab (248 kg/ha), Andhra Pradesh (247 kg/ha), Telangana (220 kg/ha), and Haryana (214 kg/ha) exceeds the national average (145 kg/ha). Consequently, India over-produces paddy, which degrades the environment and is thus unsustainable. Alternatively, a 2-step approach can incentivize farmers to shift from paddy to millets and minimize ecological risks.

Firstly, the paddy farmers can be offered cash incentives for not producing paddy, allowing the government to save on subsidies and procurement costs. These savings can then fund millet production, farmer-oriented awareness programs, promote crop diversification, agricultural digitalization, infrastructural upgradation for crop storage, agro-processing, and management of post-harvest losses, cost-effectively. This could subsequently change the overall sentiment of the market in favour of millet.

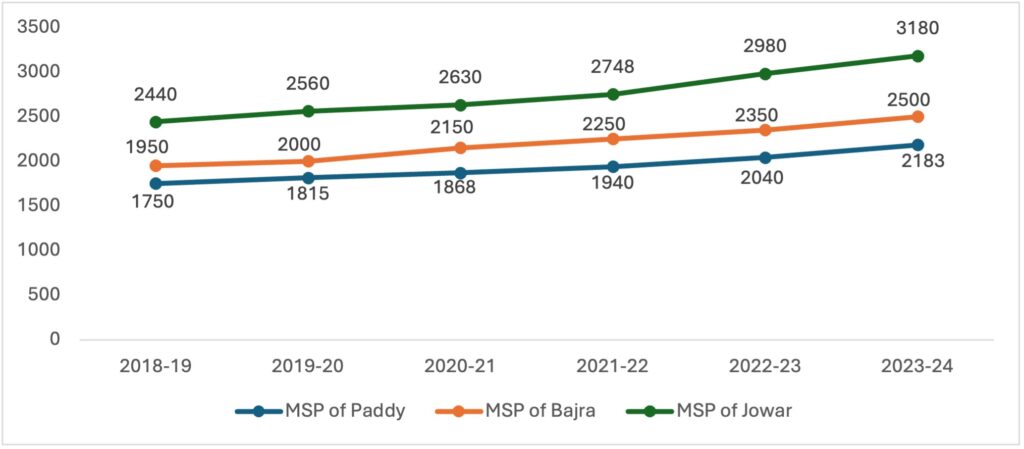

The government has rolled out a couple of schemes to promote millet production and consumption, highlighting its high nutritional value, and the MSPs for millets like bajra and jowar are also higher compared to paddy. (Figure 1).

Figure 1: Minimum Support Price of Paddy and Millet in India between 2018-19 and 2023-24 (in INRquintal)

Source: DES| MSP- Paddy & Millet

Yet, paddy production is dominant in Indian agriculture, specifically the Indo-Gangetic Plains, and that is mainly due to policy provisions for paddy. For instance, the Food Corporation of India (FCI) undertakes assured procurement of paddy at MSP. This provides the paddy farmers with a guaranteed price. In contrast, millets lack such a system. Specifically, in 2022-23, compared to the paddy off-take from Punjab (18.21 million tonnes) and Haryana (5.94 million tonnes), the millet off-take for bajra and jowar was minimal (0-140 tonnes). Besides, there are insufficient policy initiatives promoting fortified millet varieties. Although the MSP of bajra and jowar increased between 2021-22 and 2023-24, millet production and cultivation area grew at a lower CAGR compared to the MSP (Table 1).

Table 1: CAGR of the MSP, Production and Area under Bajra and Jowar in India (2021-24)

| Millet | CAGR of MSP | CAGR of Production | CAGR of Area |

| Bajra | 3.57% | 3.11% | 2.57% |

| Jowar | 4.99% | 4.53% | 2.40% |

The current MSP and policy support for millets in India is inadequate to markedly transform millet production. To turn the tide, the farmers need better price support on millet, in addition to the cash incentives offered. The government savings, net of cash incentives given to the farmers, can fund the higher MSP on millets and assure their procurement by the FCI.

Moving forward, the Indian government increased the MSP on bajra by 77% to INR 4,375/quintal in 2024-25. This could help the farmers double their income in a few cropping seasons, with Rajasthan and Madhya Pradesh being the top millet-producing states of India and experiencing the fastest impact (Table 2).

Table 2: Impact of a 77% Increase in MSP of Bajra on Farmers’ Income

| MSP of Bajra (INR/quintal) | Farmer’s Income (INR/ha) | |||

| Punjab | Haryana | Rajasthan | Madhya Pradesh | |

| 2500 | 60692.82 | 64498.76 | 13492.2 | 29798.21 |

| 4375 | 74192.82 | 114522.8 | 39712.66 | 85566.57 |

| Change (%) | 20% | 77% | 94% | 287% |

Similarly, if the MSP of jowar is revised upwards by say, 50% from INR 2980/quintal to INR 4470/quintal, farmers’ income at least doubles in Madhya Pradesh and Rajasthan to INR 59633/ha and INR 23880/ha, respectively. In Haryana, farmers already earn more from jowar production compared to those in Madhya Pradesh and Rajasthan. So, a 50% rise in the MSP for jowar would increase farmers’ income in Haryana by 12%, which is a smaller percentage increase, but effectively a higher jump to INR 72,340/ha.

The FCI can significantly boost millet production by ensuring MSP-backed procurement of bajra and jowar, providing farmers with a guaranteed market, stable income and prices, and thus, reduce the risk of distress sales. Scaling up the Production Linked Incentive Scheme for Millet-based Products (PLISMBP) for FY 2022-2026 and leveraging the Public Distribution System (PDS) can further enhance millet consumption. Finally, the Department of Food & Public Distribution can collaborate with NGOs and educational institutions to further promote millets through workshops, seminars, and media campaigns. Despite being a top-five millet exporter, India contributes only 2% to global exports. With the millet market expected to exceed USD 14 billion at a CAGR of 4.6% between 2019-2027, India must strengthen its millet value chains and enhance exports to boost economic welfare.

To revolutionize millet production in India, a multifaceted strategy is essential. Offering cash incentives, coupled with a higher MSP for millets, better procurement infrastructure, and awareness, along with policy support and incentives like carbon credit, can be viable strategies to achieve the end goal. The potential payoff? Doubling farmers’ incomes within a few cropping seasons, promising economic benefits, and paving the way for a more sustainable and resilient agricultural future.

The article was published with Financial Express on May 6, 2025.